What is Economic Time Machine?

|

| Economic Time Machine is real! |

What if I tell you that we have been using the so-called time machine for centuries already? You don't believe me? But trust me, I'm an Economist (or am I?). This time machine is imperfect though. It only allows you limited access into the future and only to yourself. But hey, that is still quite something!

It was born out of innovation in resource redistribution! It is an Economic Time Machine! ETM for short (I completely made that term up)!

The first ETM , according to Wiki and historyworld.net, dates back to around 2000 BC in the ancient city of Babylon! No, I am not kidding. ETM has been employed ever since throughout human history. It has evolved through time and is now, in our modern world, known as the "Bank". Shocked? Don't be. You will see why in a minute... more or less depending on your reading speed.

| No, there is no Time Machine inside. |

What do I mean by that? You see, you might think that when you borrow money from a Bank, you actually borrow money from the Bank. Not really. That is a false logic at 2 different levels.

First, let me tell you that, the money you borrow almost always belong to someone else. Second, you are actually borrowing from yourself. Does this sound crazy to you? But I am not insane. Let me take you off track a little bit so you get a better view of the concept.

What do Banks offer? Operational Efficiency, Allocative Efficiency, and Money Multiplier

Essentially, banks just make borrowing and lending way more convenient by acting as a medium/intermediary. Just like a market where buyers are connected to producers without them ever having to face each other, banks are places where borrowers are linked to savers (who have loanable fund) without them having to meet, without them having to interact with and hate one another. This significantly reduces the cost of loan transactions because it eliminates risks due to inside lag, outside lag, moral hazard, and asymmetric information. Inside lag can be a result of prolonged unsettled negotiation or conflict between borrowers and lenders if they are to face each other directly. Outside lag can be due to document processing and formality required/done by third parties in public service before the loan can happen. Moral hazard can be the inclination of borrowers or lenders to violate the term of loan should there exist opportunities as a result of loopholes within the contract (or the grey area that is not clearly defined). Asymmetric information can increase risk (and thus, risk premium/interest rate charged on loan) as a result of uncertainty, for example, that lenders have on the ability of borrowers to repay the debt. These are all inconvenience that substantially drives the cost of borrowing (or in fancy term: "interest rate") up.

Plus, if bank did not exist in the first place, should there be default on any loan made, all the risk would fall directly upon the lenders, rendering them bankrupt in the worst-case scenario (it actually can get worse than the worst-case scenario if the lenders somehow ended up in jail or committed suicide... who knows...). However, Bank, as a large institution operating at large scale over a variety of financial transactions, can significantly diversify the risk (and thus, cost). Simply put, by making many loans continuously over the course of time, banks are able to generate considerable gain that offsets the loss incurred. Individuals who lend small amount of money with limited number of loans are not able to do this because the loss and gain of each loan matters way more. For instance, with only 2 loans made, if one is a bad loan, you are pretty much screwed. Well, hope you get the idea.

To sum up, what mentioned so far are all related to "Operational Efficiency". Banks enjoy lower cost as it operates at a large scale allowing the risks it bears to be diversified by a great degree. This is also known as "Economies of scale", something we discussed before.

If you want to learn more about Economies of Scale, visit the link below:

http://economind101.blogspot.com/2014/12/cheaper-more-economies-of-scale.html

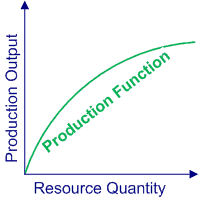

Another perk of having banks running the financial component of our economy is "Allocative Efficiency". Simply put, banks are driven by incentive to cut cost and allocate resources to where they are most needed; and where resources are most demanded are usually within areas/economic activities that yield highest return per unit of investment or capital input. Basically, this is what guarantees repayment of loans. To tie things up, individual or institutional borrowers who plan to use resources in such high-return economic activities are deemed credit-worthy, and this type of borrowers are whom banks most likely channel their resources to. This process is what makes banks so efficient and effective. Their thirst for optimal return to each loan made causes them and the aggregate economy in which they operate to become much more efficient and flourishing if compared to those with dysfunctional banking system.

Of course, for the above mentioned to happen, it requires firmly established rules and regulations so that the incentive to seek profit does not run wild. The lack of such rules and regulations, the misuse of policy, the oversight of the inherent risks of capitalism and free market, can lead to financial instability and eventually to severe economic consequences just like the global financial crisis in 2008.

That's not all. On top of operational and allocative efficiency, banks also create more money out of money! This entire process is called Money Multiplier! If you are thinking about money printing, then, no, this is not the same. I'll give you an example of how a bank uses money to create more money:

Consider a scenario in which you deposit $100 into a bank. Bank normally puts a portion of your deposit into their vault, which is known as reserve. If the reserve ratio is 10%, then $10 of your initial $100 will be kept. What does bank do with the $90? They loan it out or invest it in stuffs. Say, if they lend the 90$ to your friend, do you think the total amount of money is still $100? True, the monetary base is still $100. The actual amount does not change. However, when banks are taken into account, the amount of aggregate money supply is expanded beyond the initial monetary base. In your case, the $90 (that has been loaned out) has actually become a new addition to the total money supply. You actually still have $100 in your bank, but your friend now also has the $90 lent to him. So, the aggregate amount of money in the economy is now $190. If your friend deposits the $90 into his own account, bank can then keep 10% of that (or $9) as reserve. They can then loan out the remaining $81. And someone else in the economy will receive the $81 created out of thin air. Then, the economy will have $100 + $90 + $81, a total of $271! This keeps repeating itself. And I guess you get the idea. More money created out of a fixed amount of monetary base. That's just so cool.

Check out another article of Economind to learn more about Multiplier:

http://economind101.blogspot.com/2013/12/understanding-multiplier.html

So, these are some of the merits of the so-called Bank. Yes, the role of bank is not a direct lender, but an agent that match the supply of money to the demand for money. Simply magical. What I am trying to tell you is that banks exist because of the advantages they offer that attract depositors and borrowers, and make them a critical component in economic development, not because they (banks), themselves, were born with truckloads of cash for people to borrow. They simply take money from one person and loan it to another. They make profit from the "net interest rate spread": the difference between the interest banks pay depositors and the interest banks charge their borrowers. That is how banks sustain themselves and drive them to operate and allocate efficiently.

How is Bank a Time Machine? Is that even possible?

Before the long explanation, I did mention that those who think they are borrowing money from banks misconceive at 2 differently levels. First, just like what have been discussed so far, you actually borrow money from another person or group of persons.Second, when we dive deeper into the idea, when you take out a loan from a bank, you are neither borrowing from the bank nor other people; in fact, you are actually borrowing from your future self!! (My god... this twisted, confusing plot makes it feel a little bit like "Inception"). Banks allow you to easily access future resources the future you hold, which are otherwise unavailable and inaccessible to your present self. That is exactly why I call it "the Economic Time Machine"!

The thing is when you borrow in the present to spend more, you will have to save more and spend less to repay the debt in the future. In other words, your future self will have to work his/her butt off to pay for the loan your present/past self took. If you borrow to invest in your start-up or existing business expansion, that is like asking for your future self to make you advance payment from your future self's earning to elevate your own investment or business outcomes. Of course, no matter what the outcomes may be, you (your future self) will still have to pay for the loan.

For this reason, consumer loans (borrow to buy new TV, Game console, New clothes, etc that do not enhance your future earning potential) are more risky because you are just borrowing from yourself to spend more now (and less in the future). If your earning does not increase over the course of the loan period, your future self will have to suffer the consequence. He/she will have less to spend and maintain the living standard you once enjoyed. Investment loans, on the other hand, elevate your income generation capability, and thus, you are actually increasing the overall well-being for your future self.

For the same reason, at macro level, banks that are not properly regulated and that give out too much consumer loans without properly assessing the ability of the borrowers to pay it back will face higher risk of default on loans by the borrowers.

The global financial crisis, the Dire Consequence resulted from the Misuse of the Economic Time Machine

In essence, lending recklessly was what ignited the onset of the global financial crisis back in 2008. Let's talk a little bit about it, shall we?

Well, back then, American banks ignored 2 important factors that make a borrower credit worthy: their income generation capability and their assets (that can be used as collateral). Banks gave out easy residential loans (for people to buy their own home and live the American dream), and they did not care much about the borrowers' credit worthiness. No down payment, no collateral, no string attached. If borrowers can no longer pay back their debts, they can simply forfeit their new home and never return. The banks will seize the houses. Simple like that. Is that profitable? Oh yes, it was a lucrative business. Very rewarding. Despite some warning from a bunch of Economists, the home mortgages were put into packages known as Collateralized Securities, rated super safe by the rating agencies, and sold to investors who were at that time very optimistic. Why?

Most of those involved, including the Banks, expected house price to keep rising because they thought there was a high demand in the market. So, even if the borrowers were unable to pay back the loans, banks thought everything was still cool because house price would just keep rising (due to the apparent strong demand) and they would still make good money out of the loan (when they seized and sold the houses). Many people at individual and institutional levels eventually got involved, but they did not realize that the demand was artificial (i.e. not much real demand for home). Many people bought houses in hope of capital gain (sell the houses to make good profit). However, as more purchases were made with the same expectation in mind, it gave rise to housing bubble (artificial inflation in house price). People did not actually buy to live. They bought to sell. Following individual rationality, more and more jump on the bandwagon. This is what mal-investment means.

As time passed, they realized that in reality, there was not that much demand for houses, or to be specific, home. They could not sell the houses at the high price anticipated, so they lowered the price. The harder they tried to sell their houses, the harder it became to find real buyers. Price started to plummet. Even worst, those who actually moved into their newly bought home were unable to afford to live in one. They were not even credit worthy to begin with. Their current "future self" (if that made any sense at all) could not earn enough to pay the mortgage. Defaults swept the housing market. The financial sector could not handle the immense stress and it snapped. The bubble burst. The economy crumbled. Stock price plunged. Gold price fell sharply at first as investors sought to refinance their losses and as the US currency was, at the beginning (if I am correct), considered safe haven for investment. The change in many investors' portfolios was indeed scary. It was a dark time for the global economy. Even countries like Cambodia can feel the impact, especially on one of its main export sector, garment. As reported by the PhnomPenh Post in October 9th 2008, and I quoted: "62,100 garment workers have experienced job loss as of april 2008, bre wing a general feeling of uncertainty and fear in workers."

|

| The East definitely felt the impact from the Crisis of the West! Image source: http://data.worldbank.org/news/mdg-challenges-from-2008-financial-crisis |

Bad Experience, Good Lesson

This is one bad experience that yields a good lesson learnt. Individuals and institutions in public and private sectors alike need to be prudent and borrow/lend wisely by following clear criteria for loan evaluation. Expansionary policies should be implemented with utmost caution to avoid unnecessary losses. Standard must be established, trade-offs evaluated, options presented and priorities set. These will allow money to be allocated to those whose future selves are able to make effective uses out of the scarce resources and make due repayment for the loan they took.Long term solutions demand social, political, and economic structural changes. Decentralization and Diversification of economy are something to be carefully considered, something I would love to talk about in a later article after I have done my homework (research about the topics) a bit more.

This is all for now, and I hope you've learnt a great deal from this article. Constructive feedback is welcome.

----------------------------------------------------------------------------------------------------------

References used:

http://en.wikipedia.org/wiki/History_of_banking

http://www.historyworld.net/wrldhis/PlainTextHistories.asp?historyid=ac19

https://www.cambodiadaily.com/archives/garment-industry-continues-to-shed-jobs-63998/

http://www.phnompenhpost.com/special-reports/job-losses-garment-sector